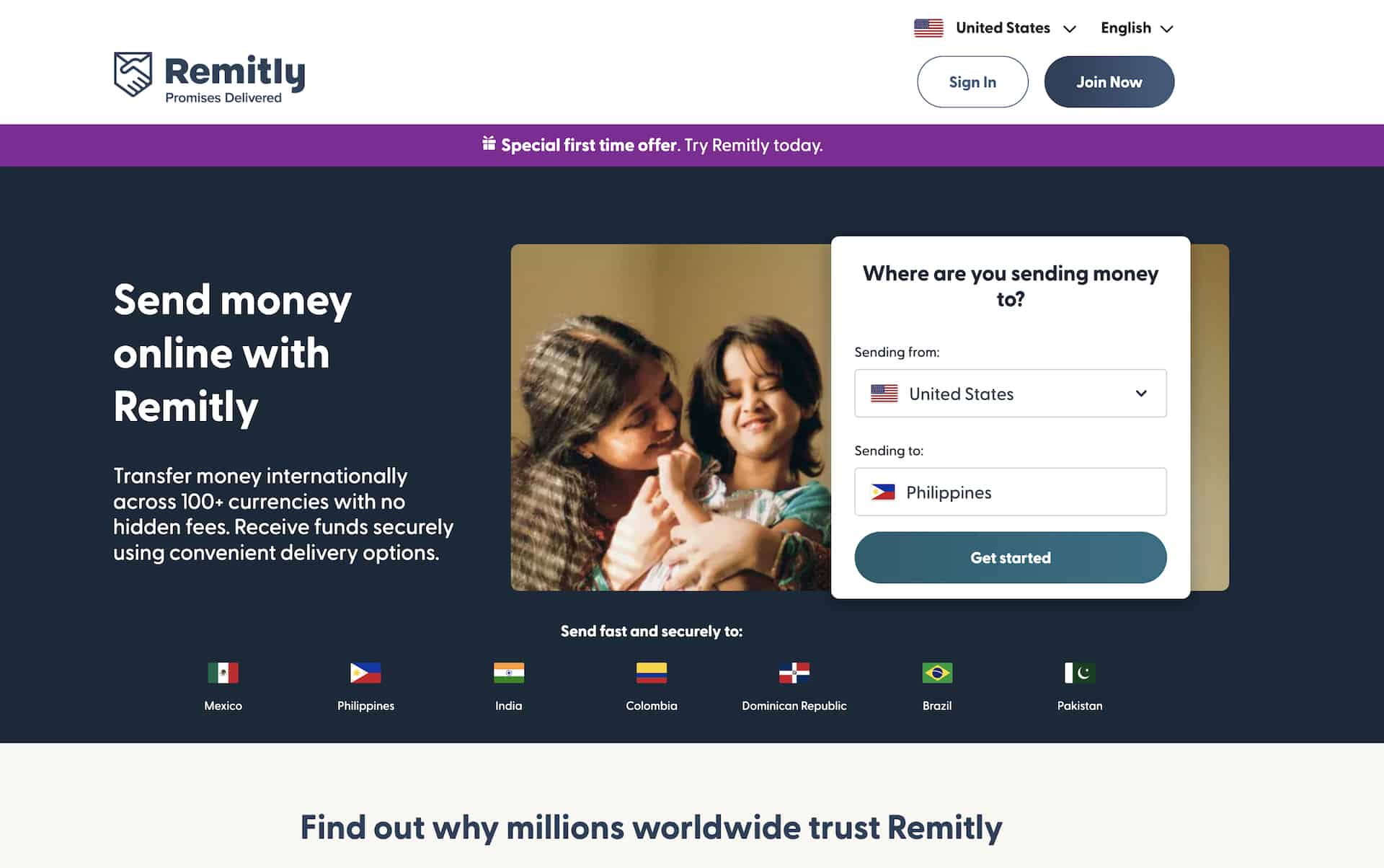

Using the Remitly App to Safely Transfer Money

The Remitly App and website have revolutionized the way we think about international money transfers. Their commitment to security, transparency, and efficiency sets them apart in a crowded market. Whether you’re supporting loved ones, making business transactions, or just need to add cash to your GCash account in the Philippines, Remitly is a reliable choice. As our world becomes ever more interconnected, having a trusted partner like Remitly to facilitate these financial connections is invaluable.

The world has never been as connected as it is today. With the touch of a button, one can send messages, make calls, and even transfer money across continents. This last function has become increasingly essential for millions around the world. Whether you’re supporting family back home, settling payments, or simply trying to add cash to a digital wallet, the need for a secure and efficient money transfer method is paramount. Enter: Remitly.

In this article, we’ll delve into the reasons for using Remitly, as well as provide practical examples of how you can utilize the Remitly App and Remitly website to transfer money safely to recipients in the Philippines, and even top up your own GCash account.

Why Choose Remitly?

- Trustworthiness and Security: One of the primary concerns when transferring money internationally is the security of the transaction. You want to be sure that your money reaches its intended destination without falling into the wrong hands. Remitly ensures high security by implementing industry-leading safety protocols and encryption. With a trusted track record and countless positive reviews, you can send money confidently, knowing it’s in safe hands.

- Speed and Efficiency: With Remitly, there’s no need to wait for days on end for your transfer to complete. Depending on the transfer type you choose, your money can reach its destination in minutes. This quick turnaround is invaluable, especially in emergencies or when time-sensitive payments need to be made.

- Transparent Fees: One of the major gripes users often have with some money transfer services is the lack of transparency in fees. With Remitly, users are made fully aware of the transaction costs upfront, allowing for an informed decision every time.

Sending Money to Someone in the Philippines

Example 1: Supporting a Family Member

John, a Filipino expatriate working in Canada, regularly sends money back home to support his aging parents in Cebu. He had previously used various methods, from bank transfers to other money transfer services, but was often frustrated by hidden fees, slow delivery times, or complex processes.

When John discovered Remitly, he was instantly attracted to its straightforward approach. By simply downloading the Remitly App and setting up his account, he could select the Philippines as the destination country, input the recipient’s bank details or choose cash pickup options, and then transfer the desired amount. His parents received the funds within the promised time frame, and the transparent fee structure meant no unpleasant surprises.

Example 2: Paying for Services or Goods

Maria, an entrepreneur based in Australia, frequently collaborates with freelancers from the Philippines. To ensure timely and secure payments, she uses Remitly. The process is seamless: after agreeing on the payment amount with the freelancer, Maria logs onto the Remitly website, enters the payment details, and sends the funds. The freelancer then receives a notification, and the money is available in their bank account or for cash pickup, depending on their preference.

Adding Cash to Your GCash Account in the Philippines

Example 1: Personal Use

Rahul, an Indian national, often travels to the Philippines for business. During his stays, he finds it more convenient to use GCash, a popular e-wallet in the country, for his daily transactions. Instead of constantly looking for money changers or withdrawing from ATMs with added fees, Rahul uses Remitly to top up his GCash account directly. By selecting the option to send to a GCash wallet on the Remitly platform, he can instantly add funds and continue with his transactions without a hitch.

Example 2: Helping Out a Friend

Linda, a Singaporean, has a close friend, Mia, living in Manila. When Mia found herself in a tight spot financially, Linda wanted to help. Rather than sending money to Mia’s bank, which could take days, Linda decided to top up Mia’s GCash account via Remitly. This allowed Mia to access the funds almost immediately and resolve her urgent needs.

Add comment