Travel Insurance Philipines

Travel insurance in the Philippines offers essential protection for travelers, covering medical emergencies, trip cancellations, and lost luggage. It's a crucial safeguard for exploring the country's diverse landscapes and cultural attractions, ensuring peace of mind through comprehensive coverage and support during unexpected events.

Top 10 Questions and Answers about Travel Insurance in the Philippines

What is Travel Insurance in the Philippines?

Is Travel Insurance Mandatory for Traveling to the Philippines?

Does Travel Insurance in the Philippines Cover COVID-19?

What Should I Do If I Need Medical Attention in the Philippines and Have Travel Insurance?

Can I Purchase Travel Insurance After Starting My Trip to the Philippines?

Are Pre-Existing Medical Conditions Covered by Travel Insurance in the Philippines?

How Does Travel Insurance in the Philippines Handle Trip Cancellations?

What Is Not Covered by Travel Insurance in the Philippines?

How Do I File a Claim with My Travel Insurance in the Philippines?

What Should I Consider When Choosing Travel Insurance for the Philippines?

Important Topics about Travel Insurance Philippines

Get Superior Travel Insurance for You and Your Family's Trip at a Very Competitive Price

Obtaining superior travel insurance for your family's trip is essential for peace of mind. Fortunately, finding a policy that offers comprehensive coverage at a competitive price is now more accessible than ever. With customizable travel plans to suit various needs and budgets, you can ensure that your family is well-protected on your travels, without overspending.

Medical Emergency Insurance and Emergency Medical Evacuation

Medical emergency insurance is a critical aspect of travel insurance, covering unexpected health issues that may arise during your trip. Coupled with emergency medical evacuation, it ensures that, in case of a serious medical emergency, you have access to the necessary medical care, even if it means using public transportation or to a facility equipped for specific treatment needs.

Gear Theft Protection

Gear theft protection is a must for travelers carrying expensive equipment like cameras, laptops, or sporting gear. This coverage provides peace of mind, knowing that your valuable items are protected against theft, loss, or damage, allowing you to focus on enjoying your journey.

Recovery of Travel Expenses

Travel insurance policies often include the recovery of travel expenses, providing reimbursement for non-refundable expenses in case of unexpected trip cancellations or interruptions. This coverage is invaluable in safeguarding your investment in your travel plans.

Best Coverages to Choose from for You and Your Family's International Travel

When planning international travel, choosing the best coverage for you and your family is vital. Look for policies that include medical emergencies, trip cancellations, and personal liability, ensuring a comprehensive safety net for various situations you may encounter during international travels abroad.

Travel and Claims Assistance

Travel and claims assistance services are an integral part of travel insurance. These services offer support during your trip, such as assistance with your lost passports, documents or emergency situations, and guide you through the process of making a claim, simplifying what can often be a complex process.

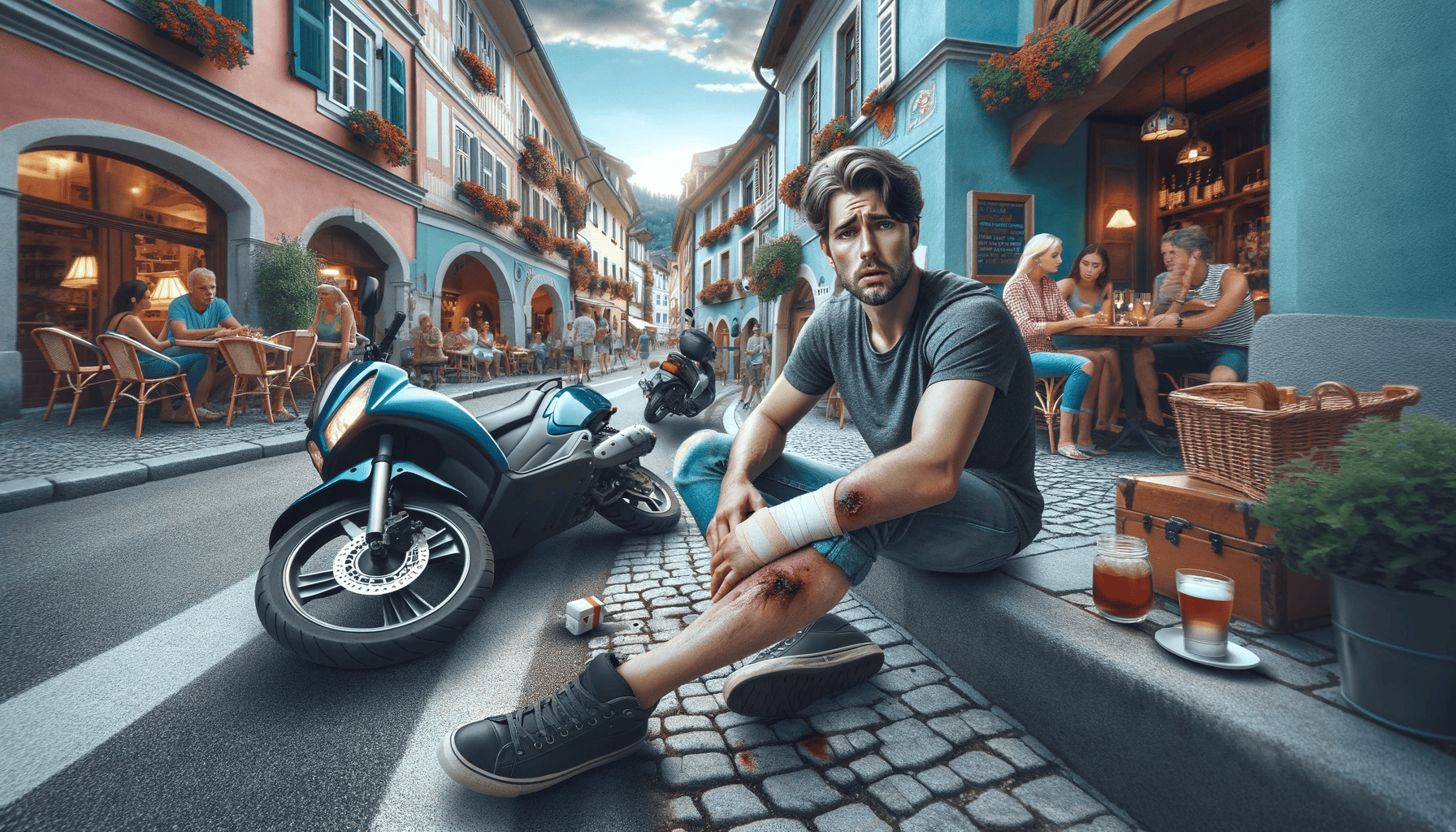

Personal Accident Benefits

Personal accident benefits provide compensation in the unfortunate event of an accident resulting in injury or death. This coverage is a crucial component of travel insurance, offering financial support to the traveler or their family during difficult times.

Take Advantage of These Top-Tier Benefits

Taking advantage of top-tier benefits in travel insurance can significantly enhance your travel experience. From comprehensive medical coverage to trip cancellation and personal accident benefits, these features offer extensive protection, allowing for a worry-free journey.

Damage and Baggage Losses Coverage

Damage and baggage losses coverage is a key feature in travel insurance, providing compensation for damaged, lost, or stolen luggage and personal belongings. This coverage is essential for mitigating the inconvenience and financial loss associated with baggage issues.

Starting Base Premium for Up to 4 Days Stay

For short trips, the starting base premium for travel insurance offers an affordable way to secure coverage for up to four days. This option is ideal for weekend getaways or brief business trips, providing essential coverage without the cost of a longer-term policy.

Travel Inconvenience Benefits

Travel inconvenience benefits cover the minor, yet frustrating, aspects of traveling, such as flight delays, lost luggage, or missed connections. These benefits can provide compensation and assistance, reducing the stress and inconvenience of such disruptions.

Trip Cancellation or Interruption Coverage

Trip cancellation or interruption coverage is crucial in travel insurance, offering reimbursement for non-refundable travel expenses in case of unforeseen events that disrupt your travel plans elsewhere. This coverage ensures that unexpected circumstances do not lead to significant financial loss.

Personal Liability Benefits

Personal liability benefits protect you in the event that you are held legally responsible for causing injury to someone or damaging property while traveling. This coverage is an important safeguard against potential legal and financial repercussions.

Travel Assistance Benefits

Travel assistance benefits offer various support services during your journey, such as help with medical emergencies, legal issues, or travel disruptions. These services are invaluable in navigating unforeseen challenges and ensuring a smooth travel experience.

Get Insured Today!

Getting insured today is easier than ever. With a range of policies available online, you can quickly find and purchase a travel insurance plan that suits your needs, ensuring you are protected on your upcoming travels.

Choose a Product

Choosing the right travel insurance product involves assessing your specific, travel coverage needs and comparing different policies. Consider factors like the destination, duration of the trip, and the activities you plan to engage in to select the most suitable, comprehensive travel insurance coverage amount.

Send All the Documents and Proof to Your Insurance Provider

In the event of a claim, sending all relevant documents and proof to your insurance provider is crucial. This includes medical reports, police reports, receipts, and any other documentation that supports your claim, ensuring a smooth and efficient claims process.

Purchase Different Coverages Suited to Your Trip

Purchasing different coverages suited to your trip allows for a tailored insurance experience. Whether you need additional medical coverage, protection for adventure sports, or extra coverage for expensive equipment, customizing your policy ensures comprehensive protection.

Rental Insurance

Rental insurance is an important consideration for travelers using rental vehicles. This coverage can protect against damage or theft of the rental car, providing financial protection and peace of mind while on the road.

Experience Hassle-Free Travel Insurance to Schengen Countries

Experiencing hassle-free travel insurance for Schengen countries is essential for international travels, as these countries often have specific insurance requirements for entry. Look for policies that meet these requirements, ensuring a smooth and compliant travel experience.

Why Do You Need Travel Insurance?

Travel insurance is essential in managing the risks associated with travel, from medical emergencies and trip cancellations to lost luggage and personal liability. It provides financial protection and support services, making it a crucial aspect of any travel plan.

Enjoy Easy Premium Payment Methods

Enjoying easy premium payment methods makes purchasing travel insurance convenient. Most providers offer various payment options, including online transactions, making it simple to secure your policy before your trip.

Travel Insurance Claims

Navigating travel insurance claims requires understanding your policy and the claims process. In the event of a claim, prompt communication with your provider and providing all necessary documentation are key steps in ensuring a successful claim.

Other Travel Insurance Coverage

Other travel insurance coverage can include specific protections like extreme sports coverage, protection for electronic devices, or additional medical coverage for high-risk destinations. These options allow for a customized insurance policy tailored to your unique travel needs.

Travel Insurance Philippines Facts

1: Introduction to Travel Insurance in the Philippines

The concept of travel insurance in the Philippines is gaining significant traction, especially in the wake of global uncertainties and the increasing awareness among travelers about the unforeseen risks associated with both domestic and international travel. This comprehensive exploration into travel insurance in the Philippines aims to demystify the various facets of travel insurance, emphasizing its crucial role in safeguarding travelers from a myriad of potential mishaps.

The Essence of Travel Insurance in the Philippines

Travel insurance in the Philippines, a country known for its picturesque landscapes and vibrant culture, is not merely an optional add-on but a necessity for anyone planning a trip. Whether you are a solo adventurer, a family on vacation, or a business traveler, understanding the scope and benefits of travel insurance is paramount. The primary objective of travel insurance is to provide financial security and peace of mind, covering unexpected events that could otherwise turn a dream vacation into a financial nightmare.

Comprehensive Coverage: More Than Just a Safety Net

When it comes to travel insurance, the term "comprehensive" is often used. Comprehensive travel insurance in the Philippines typically encompasses a wide range of eventualities, including medical emergencies, trip cancellations, lost baggage, and even rental car coverage. This broad scope ensures that travelers are protected against the most common travel-related risks.

Medical Emergencies and Health-Related Coverage

One of the most critical aspects of travel insurance is coverage for any medical expenses abroad. Travelers often overlook the potential cost of medical emergencies abroad, which can be astronomically high, especially in countries where healthcare is predominantly privatized. Travel insurance in the Philippines provides a safety net, covering medical costs and ensuring access to necessary medical treatment without the worry of exorbitant travel expenses alone. This coverage extends to emergency medical situations, offering relief in the most stressful scenarios.

Emergency medical evacuation is another vital component of travel insurance. In scenarios where medical treatment is not available locally, or if a specific type of medical care is required, medical evacuation coverage ensures that the traveler can be transported to an appropriate facility, potentially saving lives in critical situations.

Trip Cancellation and Other Inconveniences

Another crucial aspect of travel insurance is coverage for a trip delay, postponement or cancellation. Plans often go awry due to unforeseen circumstances, and without travel insurance, the financial implications of a trip delay, postponement or cancellations can be burdensome. Whether it's due to personal health issues, family emergencies, or other unexpected events, the trip postponement, delay or cancellation coverage in travel insurance policies can reimburse nonrefundable trip costs, mitigating financial losses.

Travel inconvenience benefits are also an integral part of travel insurance in the Philippines. These travel inconvenience benefits offer compensation for smaller, yet significant, inconveniences like travel delays, baggage delays, and lost luggage. Such coverage ensures that travelers are not left stranded or inconvenienced financially due to common travel mishaps.

Personal Accident Benefits and Liability Coverage

In the unfortunate event of an accident, personal accident benefits in travel insurance provide a financial cushion. This coverage typically includes compensation for accidental death and disability, offering support to the traveler or their family in dire circumstances.

Personal liability coverage is another aspect that should not be overlooked. It protects travelers in cases where they might be held legally responsible for causing injury to others or damaging property during their trip. This type of coverage is essential, as legal liabilities can lead to substantial financial demands.

The Role of Insurance Companies in Providing Travel Insurance

Insurance companies in the Philippines play a pivotal role in offering travel insurance policies tailored to various needs. It is crucial to choose the right insurance provider, one that not only offers comprehensive coverage but also has a reputation for efficient claim processing and customer support. Different travel insurance companies offer varied coverage options, policy limits, and exclusions, making it imperative for travelers to conduct thorough research before selecting a policy.

Travelers should pay close attention to the terms and conditions of the travel insurance policy, ensuring they understand what is and isn't covered. This due diligence is crucial in avoiding disappointments when filing a claim. The insurance policy document should be read meticulously, focusing on coverage limits, exclusions, and the process for filing a claim.

The Growing Importance of Travel Insurance in the Philippines

In recent years, the importance of travel and health insurance, has been underscored by various global events, including the COVID-19 pandemic. The pandemic has brought to light the numerous uncertainties associated with travel, making travel and health insurance more relevant than ever. Travel and health insurance in the Philippines now often includes coverage for COVID-19 related medical treatment and trip cancellations, reflecting the evolving needs of travelers in the current scenario.

Conclusion

In conclusion, travel insurance in the Philippines is an indispensable part of any travel plan. It offers much-needed protection against a range of unforeseen events that could otherwise disrupt travel plans and lead to significant financial losses. From covering medical expenses and providing emergency medical support to ensuring financial compensation for trip cancellations and travel inconveniences, travel insurance is the safety net every traveler needs.

As the world becomes increasingly interconnected and as people continue to explore new destinations, the role of travel insurance becomes more prominent. The peace of mind and security it provides cannot be overstated, making travel insurance not just a wise choice, but a necessary one for anyone traveling in or out of the Philippines.

2: Understanding Travel Insurance Coverage in the Philippines

The landscape of travel insurance in the Philippines encompasses a variety of coverage options designed to address the diverse needs of travelers. From dealing with medical emergencies to mitigating the financial impact of trip cancellations, understanding the intricacies of travel insurance coverage is crucial for anyone planning a journey, whether within the archipelago or abroad.

The Breadth of Travel Insurance Coverage

At its core, travel insurance coverage in the Philippines is designed to protect travelers from the financial strain of unexpected events. This protection extends across various aspects of travel, from medical expenses to the loss of personal belongings. It's essential to understand the breadth of this coverage to make informed decisions about purchasing travel insurance.

Medical Expenses and Health-Related Coverage

The coverage for medical expenses is perhaps the most critical component of travel insurance. Medical emergencies can happen anywhere, and the cost of medical treatment abroad can be prohibitively expensive. Travel insurance in the Philippines typically covers these medical costs, ensuring that travelers receive the necessary medical care without the burden of exorbitant expenses.

For those traveling abroad, the coverage for medical expenses abroad is especially vital. It not only covers the costs of treatment but also provides peace of mind, knowing that in case of a medical emergency, financial help is available. This coverage for medical costs can include hospitalization, outpatient treatment, and sometimes even dental emergencies.

Emergency medical situations require prompt and effective responses, and travel insurance policies cater to this need. Emergency medical coverage is designed to offer immediate medical assistance only, ensuring that medical emergencies are handled efficiently, minimizing the potential for exacerbation of health issues.

Medical evacuation is another crucial aspect of travel insurance. In situations where appropriate medical treatment is not available locally, or a specific type of care is required, medical evacuation coverage ensures that the traveler can be transported to a facility equipped to handle their medical needs. This coverage is particularly important in remote or less developed areas where medical facilities may not meet the required standards.

Trip Cancellation and Inconvenience Benefits

Trip cancellation is a common concern for travelers, and travel insurance policies in the Philippines address this worry by offering compensation for nonrefundable trip costs in certain situations. This coverage is triggered by a variety of unforeseen events, such as sudden illness, injury accidental death, or accidental death, even the accidental death, of a family member.

In addition limited coverage due to trip postponement or cancellation, travel insurance also provides benefits for travel inconvenience. This includes coverage for travel delays, which can cause significant disruption baggage delay to travel plans. Whether it's travel delay due to weather, mechanical or public transportation issues, or other factors, travel inconvenience benefits help alleviate the financial and logistical stress caused by such delays.

Lost baggage and personal belongings coverage is another facet of travel inconvenience benefits. This part of the policy compensates travelers for the loss, theft, or damage of luggage and personal items, providing a measure of relief in such frustrating situations.

Rental Car Coverage and Personal Accident Benefits

For travelers who plan to drive during their trip, rental car coverage is an important aspect of travel insurance. This coverage typically includes a collision damage waiver, which can save the traveler from significant expenses in case of an accident or damage to the rental vehicle.

Personal accident benefits are also a vital component of travel insurance. This coverage provides financial compensation in the unfortunate event of an accidental death or disability while traveling. It's a crucial feature that offers some financial security to the traveler or their beneficiaries in case of a tragic event.

Choosing the Right Insurance Company

Selecting the right insurance company is a key step in obtaining travel insurance in the Philippines. Not all insurance companies offer the same coverage options or levels of customer service, so it's important to choose a provider that meets your specific needs.

When evaluating travel insurance companies, consider factors such as the range of coverage options, policy limits, customer reviews, and the ease of filing claims. It's also wise to compare different policies to ensure you are getting the best coverage for your investment.

The terms of the insurance policy should be reviewed carefully. Understanding what is covered, as well as the exclusions and limitations of the policy, is essential to avoid surprises when it comes time to make a claim. Pay particular attention to the coverage limits and any deductibles that may apply.

The Role of COVID-19 in Travel Insurance

The COVID-19 pandemic has had a profound impact on travel and, by extension, on travel insurance. Many travel insurance policies in the Philippines now include coverage for COVID-19 related medical treatment and trip cancellations. This addition reflects the changing landscape of travel and the need for insurance policies to adapt to new challenges.

Conclusion

In summary, understanding the coverage options and benefits of travel insurance in the Philippines is crucial for any traveler. Whether it's for protection against medical expenses, assistance during travel inconveniences, or financial security in the face of trip cancellations, travel insurance offers comprehensive protection that can make a significant difference in the experience and outcome of your travels. By choosing the right insurance company and policy, travelers can embark on their journeys with confidence, knowing they are well-protected against a wide range of unforeseen events.

3: Choosing the Right Insurance Company for Travel Insurance in the Philippines

Selecting the right of insurance products and company is a critical step in the process of acquiring travel insurance in the Philippines. This section delves into the nuances of making an informed choice among the myriad of travel insurance products and companies available in the market, ensuring that travelers secure a policy that best suits their needs.

Evaluating Travel Insurance Companies

Travel insurance companies in the Philippines offer a range of policies, each with its own set of benefits and limitations. The first step in choosing the right provider is to understand the specific needs of your trip. Are you looking for comprehensive coverage that includes medical expenses, trip cancellation, and rental car coverage? Or are your needs more focused, perhaps only requiring medical evacuation coverage or personal accident benefits?

Once you have a clear understanding of your needs, compare the offerings of different travel insurance companies. Look for providers that specialize in the type of coverage you are seeking. For instance, some companies might offer more extensive medical expense coverage, while others might have a stronger focus on trip cancellation or personal accident benefits.

The Importance of Customer Service and Reputation

When evaluating travel insurance companies, consider their reputation and customer service record. A company with a history of efficient claim processing and responsive customer support is invaluable, especially in stressful situations such as medical emergencies or trip cancellations.

Online reviews and testimonials about credit card company can provide insights into the experiences of other travelers with different credit card company and insurance companies. Pay attention to comments about the ease of filing claims, the speed of claim processing, and the overall satisfaction with the coverage provided credit card company.

Understanding the Insurance Policy

An essential aspect of choosing a travel insurance company in the Philippines is understanding the details of the insurance policy. Every insurance policy will have its own terms and conditions, which define the coverage limits, exclusions, and the process for filing a claim.

Read the policy document carefully to ensure you understand what is covered and what is not. Pay particular attention to coverage for medical expenses, as this can be one of the most significant costs associated with travel. Check the limits for medical expense coverage and whether it includes coverage for medical expenses abroad and emergency medical situations.

Also, look for details about medical evacuation coverage. In some cases, medical treatment may not be available locally, making medical evacuation a necessity. Ensure that the policy covers the costs associated with medical evacuation to a facility that can provide the required care.

Coverage for Trip Cancellation and Personal Liability

Trip cancellation coverage is another important aspect to consider when choosing a travel insurance policy. Look for a policy that provides financial protection against nonrefundable trip costs in case of unexpected cancellations due to reasons covered by the policy.

Personal liability coverage is also an important factor to consider. This coverage protects you in case you are held legally responsible for causing injury to others or damaging property during your trip. Ensure that the policy you choose provides adequate personal liability coverage.

The Role of COVID-19 in Travel Insurance Policies

The COVID-19 pandemic has brought about significant changes in the travel insurance landscape. Many travel insurance companies in the Philippines have updated their policies to include coverage for COVID-19 related medical treatment and for trip delay or cancellations. When choosing a travel insurance company, consider how they handle coverage for COVID-19 related issues.

Conclusion

In conclusion, choosing the right insurance company for travel insurance in the Philippines requires careful consideration of your specific, comprehensive travel insurance coverage needs, an understanding of the different coverage options available, and an evaluation of the insurance company’s reputation and customer service record. By taking the time to research and compare different policies, you can ensure that you have the right, comprehensive travel insurance coverage already in place, providing peace of mind and protection for your travels.

4: Travel Insurance for Specific Needs in the Philippines

Travel insurance in the Philippines is not a one-size-fits-all solution. The needs of travelers vary widely, depending on factors such as the nature of the trip, the destination, and individual circumstances. This section explores how different types of travel insurance cater to specific needs, including considerations for business travelers, limited coverage, in light of COVID-19, and unique requirements for various travel destinations, including the Schengen countries.

Tailoring Travel Insurance to Your Journey

The essence of effective travel insurance lies in its ability to cater to the specific needs of the traveler. For those embarking on business trips, travel insurance must align with the potential risks and inconveniences associated with business travel. Business travelers often face tight schedules and cannot afford delays or interruptions. Hence, travel insurance policies designed for business travelers in the Philippines might offer enhanced coverage for trip cancellations, trip delays, and lost baggage, ensuring minimal disruption to their planned engagements.

For those planning multiple trips within a year, annual or multi-trip travel insurance policies can provide comprehensive coverage over multiple journeys. This type of insurance is cost-effective and convenient for frequent travelers, as it eliminates the need to purchase a new policy for each trip.

COVID-19 Coverage: A New Essential

The COVID-19 pandemic has introduced a new dimension to travel insurance. In the Philippines, as in many other parts of the world, travel insurance companies have adapted by including coverage for COVID-19 related issues. This includes coverage for medical treatment related to COVID-19 and trip cancellations or interruptions caused by the pandemic. Given the ongoing nature of the pandemic, this coverage has become a critical consideration for travelers.

Specialized Coverage for Unique Destinations

Travelers and foreign nationals heading to specific destinations, such as the Schengen countries, need travel insurance that meets the visa requirements of foreign nationals in these nations. Schengen travel insurance typically includes a no policy limit and minimum coverage amount for medical expenses public transportation and repatriation of foreign nationals, ensuring compliance with the visa regulations of foreign nationals in the member countries.

For travelers visiting remote or adventurous destinations, travel insurance policies might focus more on emergency medical evacuation and medical expenses, considering the higher risks and potential lack of accessible healthcare facilities in such areas.

Conclusion

In conclusion, travel insurance in the Philippines offers a range of options tailored to the diverse needs of travelers. Whether it's for business travel, multiple trips, or specific destinations like the Schengen countries, there is a policy available to meet every requirement. The addition of COVID-19 coverage reflects the adaptability of the travel insurance industry in response to global health challenges, ensuring that travelers can embark on their journeys with confidence and peace of mind.

5: Dealing with Emergencies and Claims in Travel Insurance in the Philippines

The real test of travel insurance in the Philippines often comes during times of crisis or when a claim needs to be made. Understanding how to navigate emergencies and the claims process is crucial for travelers. This section provides insights into managing medical emergencies, dealing with lost luggage and travel documents, and efficiently handling trip cancellations and unforeseen events.

Handling Medical Emergencies with Travel Insurance

Medical emergencies are a primary concern for travelers, and rightly so. In such situations, the full coverage as provided by travel insurance becomes indispensable. Should you face a medical emergency while traveling, the first step is to seek immediate medical care. Most travel insurance policies in the Philippines include a 24/7 emergency medical assistance call service, which should be contacted as soon as possible. These services can guide you to the nearest appropriate healthcare facility and also coordinate with medical staff on the ground.

It's important to keep all receipts and detailed medical reports, as these are essential when filing a claim for medical expenses. The same health insurance or company will require comprehensive documentation to process any claims related to medical treatment, including bills for hospitalization, outpatient treatment, and even medications.

Navigating Medical Evacuation

In cases where medical evacuation is necessary, travel insurance in the Philippines plays a critical role. If the local medical facilities are not equipped to handle your medical needs, your travel insurance can arrange and cover the cost of transportation to a facility that can provide the required care. Understanding the terms of your medical evacuation coverage before you buy travel insurance is vital, as it will inform you of the extent of coverage and the process for initiating a medical evacuation.

Dealing with Lost Luggage and Travel Documents

Losing luggage or travel documents can be a distressing experience. Travel insurance in the Philippines typically includes coverage for such incidents, providing financial compensation and assistance in replacing lost items. If you find yourself in this situation, report the loss to the relevant authorities, such as the airline or local police, and obtain a written police report afterwards. This police report will be necessary when you file a claim with the police report your insurance company.

For lost travel documents, like passports, contact the nearest embassy or consulate. Your travel insurance provider may offer assistance services that can guide you through the process of obtaining replacements.

Managing Trip Cancellations and Unforeseen Events

Trip cancellations are another area where travel insurance in the Philippines proves its value. Unforeseen events like sudden illness, natural disasters, or even jury duty can lead to the cancellation of travel plans. If you find yourself needing to cancel a trip, contact your travel insurance provider immediately. Be prepared to provide documentation to support your claim, such as a doctor's note in the case of illness or injury.

It's important to understand the specific terms of your own trip insurance and cancellation coverage, as different policies have different stipulations regarding what constitutes a valid reason for cancellation.

Conclusion

Dealing with emergencies and claims can be a challenging aspect of travel, but having the right travel insurance in place in the Philippines can significantly ease this burden. By understanding how to handle medical emergencies, lost luggage, and trip cancellations, travelers can navigate these situations more effectively and with less stress. Knowing that you have the support and financial backing of your travel insurance company can provide invaluable peace of mind during your travels.

6: Travel Insurance Benefits and Limitations in the Philippines

When considering travel insurance in the Philippines, it's crucial to weigh both the benefits and the limitations of the policies available. This balanced understanding can help travelers make informed decisions and set realistic expectations about the extent of coverage provided by their travel insurance.

Comprehensive Coverage: A Look at the Benefits

Travel insurance in the Philippines offers a range of benefits designed to protect travelers from various unforeseen events. These benefits extend beyond mere financial compensation, providing support and assistance in times of need.

Medical Expenses and Emergency Medical Support

One of the primary benefits of travel insurance is the full coverage of of medical expenses. This aspect is particularly valuable in scenarios where travelers face unexpected illness or injury. The policies typically cover hospitalization, outpatient treatment, and, in some cases, emergency dental care. For those traveling abroad, the significance of this full medical coverage part is magnified due to the potentially high cost of medical treatment in foreign countries.

Emergency medical support is another key benefit. This includes services like 24/7 emergency assistance, which can be invaluable in navigating unfamiliar with healthcare facilities and systems. In the event of serious medical emergencies, having access to immediate professional support at healthcare facilities can make a significant difference in the quality of care received.

Assistance with Travel Inconveniences

Travel insurance in the Philippines also offers coverage for various other travel expenses and inconveniences. This includes compensation for travel delays, which can disrupt itineraries baggage delay, and lead to unexpected expenses. Additionally, coverage for lost passports, baggage lost passports, and personal belongings helps alleviate the financial burden and stress associated with such losses.

Personal Accident Benefits and Liability Protection

Personal accident benefits provide a safety net in the unfortunate event of an accident leading to injury or death. This coverage offers financial compensation to the traveler or their beneficiaries, helping to mitigate the economic impact of such tragic events.

Personal liability coverage is another important benefit. It protects the traveler from the financial repercussions of incidents where they may be held legally responsible for causing injury to others or damaging property.

Understanding the Limitations of Travel Insurance

While travel insurance in the Philippines offers extensive benefits, it's important to acknowledge its limitations. No policy can provide absolute protection against every possible scenario, and understanding these limitations is key to setting realistic expectations.

Limited Coverage and Policy Exclusions

Travel insurance policies come with certain limitations and exclusions. For instance, pre-existing medical conditions are often not covered by trip insurance only, and some activities deemed high-risk, such as extreme sports, may be excluded from health insurance only. It's essential to read the trip and health insurance only policy document carefully to understand these exclusions.

Additionally, travelers should be aware of the policy limits. Each coverage type within the policy limit will have a maximum limit, which is the highest amount the insurance company will pay for a covered loss. Knowing these limits helps in understanding the policy limit the extent of protection provided.

Navigating COVID-19 Coverage

The COVID-19 pandemic has introduced new complexities into the realm of travel insurance. While many policies in the Philippines now include COVID-19 coverage, there are often specific conditions and limitations associated with this coverage. Travelers should review these details carefully, especially considering the ever-evolving nature of travel restrictions and health advisories related to the pandemic.

Conclusion

In conclusion, travel insurance in the Philippines offers substantial benefits that can safeguard travelers against a variety of risks and challenges. However, being aware of the limitations and exclusions of these policies is equally important. By understanding both the strengths and limitations of travel insurance, travelers can make informed decisions that align with their needs and ensure a more secure and enjoyable travel experience.

7: Practical Considerations and Tips for Travel Insurance in the Philippines

Navigating the world of travel insurance in the Philippines requires more than just understanding the coverage and limitations. Practical considerations and informed decision-making play a crucial role in these travel tips and ensuring that travelers are adequately protected for their journey. This section provides essential travel tips, and considerations for purchasing and utilizing travel insurance in the Philippines, aiming to equip travelers with the knowledge needed for a secure and worry-free trip.

Timing and Purchase Considerations

The decision of when to purchase travel and travel medical insurance is as important as the decision to not buy travel insurance for it. Ideally, travel and travel medical insurance should be purchased soon after making any substantial nonrefundable trip payments. This timing ensures that the trip cancellation coverage and travel medical insurance is in effect should any unforeseen events prevent travel delay the trip from happening.

Moreover, for those who travel frequently, considering an annual travel insurance policy can be more cost-effective than buying separate policies for each trip. Annual policies typically cover multiple trips throughout the year, providing continuous coverage for regular travelers.

Assessing Coverage Needs

Each traveler’s insurance needs are unique, and the chosen policy should reflect this. For instance, adventure travelers might need a policy that covers high-risk activities, while business travelers might prioritize trip cancellation and travel delay coverage.

Understanding the scope of the medical assistance coverage is especially crucial. This includes evaluating whether the travel assistance policy covers pre-existing conditions, emergency medical expenses, and medical evacuation. Given the high cost of medical care abroad, ensuring adequate medical expense coverage is imperative.

Policy Exclusions and Limitations

It’s essential to be aware of what is not covered by your travel insurance policy. Common exclusions in travel insurance policies in the Philippines include pre-existing medical conditions, high-risk activities, and incidents caused by intoxication or drug use.

Travelers should thoroughly review their policy’s exclusions and limitations to avoid surprises when filing a claim. This understanding helps in planning the trip in a way that minimizes risks not covered by the insurance.

COVID-19 Considerations

In the era of COVID-19, travel insurance policies have adapted, but so must travelers. Policies now often include coverage for COVID-19 related medical treatment and trip cancellations, but the specifics can vary greatly. Travelers should confirm whether their policy covers quarantine-related travel expenses and any medical treatment for COVID-19, including hospital stays and medications.

Practical Tips for a Smooth Experience

- Documentation: Keep all relevant travel insurance documents accessible during your trip. In case of an emergency or when making a claim, having your policy information at hand is crucial.

- Contact Information: Save the contact information of your travel insurance provider, including the 24/7 emergency assistance number, in your phone and keep a physical copy with your travel documents.

- Understanding the Claims Process: Familiarize yourself with the claims process before you travel. Knowing what documentation is required and the steps to follow can expedite the claims process.

- Be Proactive: If an incident occurs during your trip, such as a medical emergency or lost luggage, contact your travel insurance provider as soon as possible. Immediate communication can help ensure that you receive the assistance you need.

- Keep Records: In the event of a claim, comprehensive documentation is key. Keep all receipts, reports, and records of any incidents that may require a claim.

Conclusion

Travel insurance in the Philippines is an essential component of travel planning, offering peace of mind and protection against a multitude of unforeseen events. By considering the timing of the purchase, assessing individual coverage needs, understanding policy exclusions, and being prepared for the practical aspects of utilizing the insurance, travelers can ensure they are well-equipped for their journeys. With these considerations and travel tips already in mind, travelers can focus on enjoying their trip, knowing they have a safety net in place.

8: Additional Travel Insurance Features in the Philippines

When exploring travel insurance in the Philippines, it's important to delve into the additional features and specific coverage options that can make a significant difference in a traveler's experience. This section highlights some of these key features, including emergency evacuation, repatriation of mortal remains, and specialized coverage for unique travel circumstances.

Emergency Evacuation: Understanding Its Importance

Emergency evacuation is a critical component of travel insurance, especially for travelers venturing to remote or high-risk areas. This feature covers the cost of transporting a traveler to the nearest medical facility capable of providing adequate care in the event of a severe medical emergency. The importance of this coverage cannot be overstated, as the costs associated with emergency medical transportation can be substantial.

When selecting a travel insurance policy in the Philippines, it is essential to understand the specifics of the emergency evacuation coverage. This includes knowing the circumstances under which it can be used, the process for arranging an evacuation, and any limitations or exclusions that may apply.

Repatriation of Mortal Remains

A less talked about but equally important aspect of travel insurance is the coverage for the repatriation of mortal remains. In the unfortunate event of a traveler's death, this coverage ensures that the remains can be returned to their home country. This process can be complex and expensive, and having travel insurance that covers these costs and assists with the logistics can provide significant relief during a difficult time.

Specialized Coverage for Diverse Travel Needs

Travel insurance in the Philippines offers various specialized coverage options to cater to the diverse needs of travelers. For instance, policies may offer collision damage waivers for rental cars, which can protect travelers from the financial impact of damage to a rented vehicle.

Travelers engaging in specific activities, such as winter sports or adventure tourism, might need policies that offer coverage for these activities. Similarly, those traveling on cruises might look for policies that provide specific coverage for issues common on many cruise lines' trips, like missed port calls or shipboard medical treatment.

Navigating the Complexities of Travel Insurance Policies

Understanding the intricacies of a travel insurance policy can be challenging. Each policy has its own set of terms, conditions, and exclusions, which can impact the coverage provided. For example, some policies may have limits on the coverage for lost luggage or trip delays.

It is also important to understand the policy limits, which define the maximum amount the insurance company will pay for a covered loss. Knowing these limits can help travelers assess whether the coverage provided is adequate for their needs.

Tips for Maximizing the Benefits of Your Policy

To make the most of your travel insurance in the Philippines, it's important to be proactive and informed:

- Review and Understand Your Policy: Before traveling, take the time to thoroughly review and understand your travel insurance policy. Pay special attention to the coverage limits, exclusions, and the process for filing a claim.

- Keep Important Documents Accessible: Carry a copy of your insurance policy and the emergency contact information for your insurance provider. It's also wise to have a digital copy accessible on your phone or in your email.

- Document Everything: In the event of a claim, documentation is key. Keep receipts, police reports, medical reports, and any other relevant documentation that can support your claim.

- Communicate with Your Provider: If you're unsure about the coverage for a particular activity or situation, communicate with your insurance provider before your trip. Clarifying these details in advance can prevent misunderstandings later.

Conclusion

In conclusion, the additional features of travel and insurance products and policies in the Philippines can provide crucial support in a variety of travel-related scenarios. From emergency evacuation and repatriation of mortal remains to specialized coverage for unique travel needs, these features enhance the overall value of travel and insurance products. By understanding these aspects and being prepared, travelers can embark on their journeys with a greater sense of security and peace of mind.

9: Conclusion - The Importance of Being Prepared with Travel Insurance in the Philippines

In concluding our extensive exploration of travel insurance in the Philippines, it's important to reiterate the essential role it plays in the planning and execution of any trip. This final section synthesizes the key points discussed throughout the article, underscoring the importance of being prepared with comprehensive travel insurance for any journey.

Summarizing the Benefits of Travel Insurance

Travel insurance in the Philippines offers an array of benefits that are indispensable in today’s unpredictable travel landscape. These benefits provide not just financial protection, but also peace of mind, which is invaluable when exploring new destinations or conducting business abroad.

Financial Protection and Peace of Mind

One of the primary advantages of travel insurance is the financial protection it offers against a variety of unforeseen events. This includes coverage for medical expenses, which can be prohibitively expensive, especially in foreign countries. Emergency medical coverage, including emergency medical evacuation, ensures that travelers receive the best possible care without the burden of excessive medical bills.

Travel insurance also offers compensation for trip cancellations, providing reimbursement for nonrefundable expenses if a trip is canceled due to covered reasons. This aspect is particularly significant given the uncertainty of events like natural disasters, political unrest, or personal emergencies.

Comprehensive Coverage for Diverse Needs

Travel insurance policies in the Philippines are designed to cater to a wide range of travel needs. From policies tailored for business travelers to those designed for adventure enthusiasts, there is a policy to fit every type of traveler. Specialized coverage options, such as those for rental cars, personal belongings, and accidental death, further enhance the appeal of travel insurance products.

The Role of Travel Insurance in Today’s Travel Environment

In the current global travel environment, characterized by unpredictability and ever-changing regulations, travel insurance has become more vital than ever. The COVID-19 pandemic has particularly highlighted the importance of having comprehensive travel insurance, that can adapt to new challenges, such as covering medical treatment for COVID-19 or trip cancellations due to pandemic-related restrictions.

Final Tips for Travelers

As travelers consider purchasing travel assistance and insurance in the Philippines, here are some final, travel assistance tips, to ensure they make the most informed and beneficial travel assistance choice:

- Evaluate Your Specific Needs: Assess the nature of your trip and any specific risks associated with your destination or activities planned. This assessment will guide you in selecting the most appropriate travel insurance policy.

- Compare and Contrast Policies: Don’t hesitate to compare policies from different insurance companies. Look beyond the price and evaluate the extent of coverage, exclusions, and customer service reputation.

- Read the Fine Print: Understanding the details of your policy, including coverage limits and exclusions, is crucial. This knowledge will help avoid surprises when you need to rely on your insurance.

- Prepare for Emergencies: Keep all necessary contact information and documents readily accessible during your trip. Familiarize yourself with the process of seeking assistance or filing a claim.

Embracing Responsible Travel with Travel Insurance

Travel insurance in the Philippines is more than just a safety net; it's a responsible choice for any traveler. It not only protects the individual but also ensures that unforeseen events do not lead to undue stress or financial hardship. In embracing travel insurance, travelers are not just safeguarding themselves but also contributing to a more responsible and sustainable travel culture.

10: Appendix - Frequently Asked Questions About Travel Insurance in the Philippines

To further enhance the understanding of travel insurance in the Philippines, this appendix addresses some frequently asked questions. These questions and answers aim to clarify common concerns and provide additional insights into travel insurance policies and their application in various travel scenarios.

Q1: What Exactly Does Travel Insurance in the Philippines Cover?

A: Travel insurance in the Philippines typically covers a range of situations, including medical expenses, emergency medical evacuation, trip cancellations, travel delays, lost or stolen luggage, and personal liability. The exact coverage depends on the policy chosen. Some policies offer comprehensive coverage, while others might be more basic, covering only specific aspects like medical emergencies.

Q2: Is Travel Insurance Mandatory for Traveling to and from the Philippines?

A: While travel insurance is not mandatory for all travelers to and from the Philippines, it is highly recommended. For certain destinations, such foreign countries such as the Schengen countries, travel insurance is a visa requirement. Even when not mandatory, travel insurance provides essential protection against unforeseen events.

Q3: Can I Purchase Travel Insurance After Starting My Trip?

A: It is best to purchase travel insurance before beginning your trip. Some insurance companies might allow you to purchase a policy after your trip has started, but this is less common and might come with certain restrictions or limitations.

Q4: Does Travel Insurance Cover COVID-19 Related Issues?

A: Many travel insurance policies in the Philippines now include coverage for COVID-19 related medical treatment and trip cancellations. However, the extent of this coverage can vary between policies, so it's important to check the specific terms and conditions related to COVID-19 in your policy.

Q5: How Do I File a Claim with My Travel Insurance Provider?

A: To file a claim, you should contact your travel insurance provider as soon as possible. Provide them with all necessary documentation, such as medical bills, police reports, or proof of travel delays. Each provider will have a specific claims process, so it's important to understand this process before you buy travel insurance.

Q6: Are Pre-Existing Medical Conditions Covered by Travel Insurance?

A: Coverage for pre-existing medical conditions varies by policy. Some travel insurance policies might cover pre-existing conditions if they are stable and controlled, while others may exclude them entirely. It's crucial to disclose any pre-existing conditions when purchasing a policy and to understand how they are treated in your policy.

Q7: What Should I Do If My Luggage Is Lost or Stolen?

A: If your luggage is lost or stolen during international travels, report the incident to the relevant authorities, such as the airline or local police, as soon as possible. Then, contact your travel insurance provider to report the loss and begin the claims process. Keep any reports or documentation provided by the authorities, as they will be necessary for your claim.

Q8: How Does Travel Insurance Handle Trip Cancellations?

A: Travel insurance policies typically cover trip cancellations due to unforeseen events like severe illness, injury, or natural disasters. To file a claim for a trip cancellation, provide documentation supporting the reason for cancellation, such as a doctor's note or news reports of a natural disaster.

Q9: Are Activities Like Scuba Diving or Skiing Covered by Travel Insurance?

A: Coverage for activities like scuba diving or skiing depends on the policy. Some policies cover these activities as standard, while others require additional coverage to be purchased. It's important to check your policy details and ensure that any specific activities you plan to engage in are covered.

Q10: What Is the Best Way to Choose a Travel Insurance Policy?

A: The best way to choose a travel insurance policy is to assess your specific, travel coverage needs and compare policies from different providers. Look for a policy that covers your key concerns, such as medical expenses, trip cancellations, or specific activities. Also, consider factors like coverage limits, exclusions, and the reputation of the insurance provider.